The Voice of Insurance Podcast – Clive Buesnel: Here to make our…

Listen to The Voice of Insurance podcast from our CEO, Clive Buesnel. In an incisive interview with Mark Geoghegan, Editor, Clive shares his thoughts on…

By Thomas Plumbly, Client Executive

By Thomas Plumbly, Client Executive

Latent defects insurance, otherwise known as building warranty, provides building owners with long term protection against material damage caused by structural defects. The causes of structural or inherent defects are plentiful but the most common include deficiencies in design and construction, defective material and workmanship, as well as problems associated with foundations or unforeseen ground conditions.

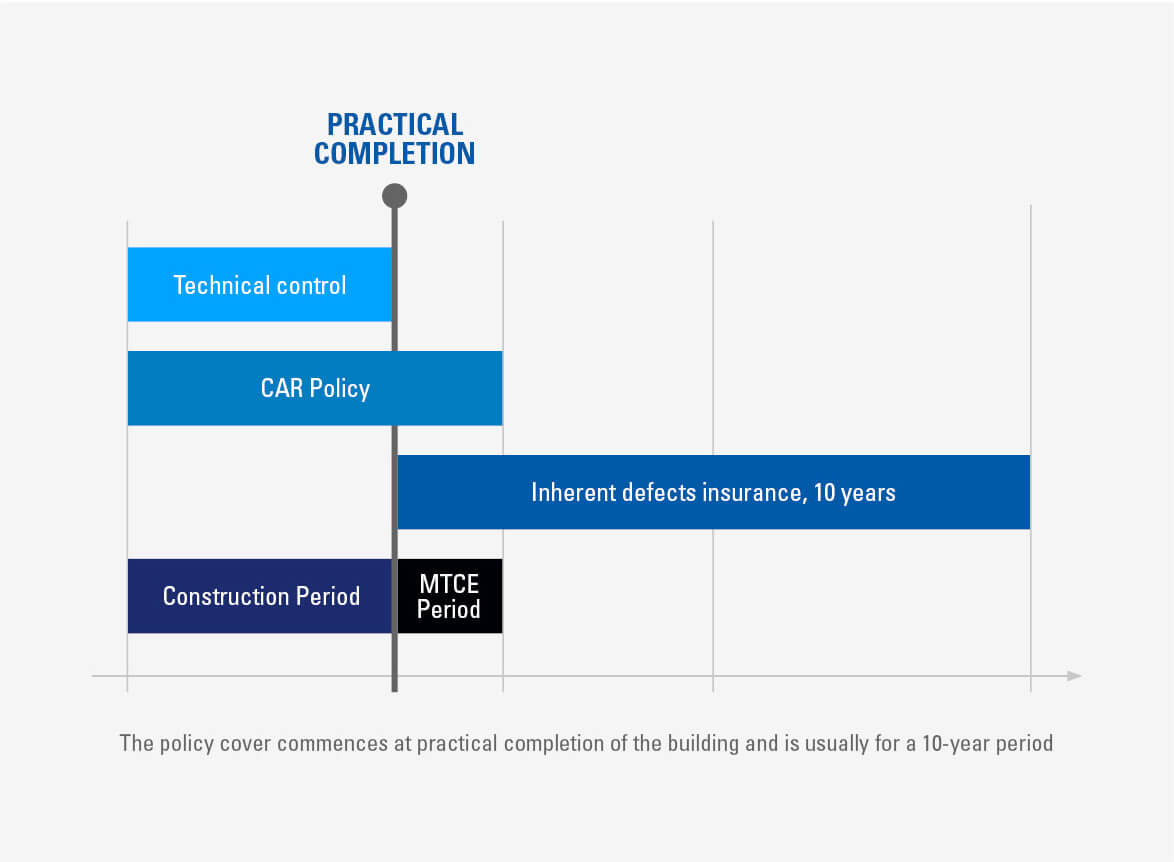

Latent defect policies vary in their length, cover can start from the date of practical completion and typically run for a period of 10 -12 years*. Shorter policies can be acquired, although as latent defects often reveal themselves over a longer period, a 10 year period is usually recommended.

No, when constructing a building, loss or damage is typically insured under a contract works insurance policy, which provides cover for repair or damage to the building on an “all risks” basis.

Following completion, a property policy is usually arranged and although also providing cover on an “all risk” basis, it will exclude cover for damage occurring out of any inherent or latent defects unless the damage is a consequence of a insured event such as fire or natural catastrophe.

* be warned there is often a builder’s (developer) liability period of two years. This means the developer will be responsible for any remediation for that period of time.

A latent defect policy is what is known as a “first party pay” policy this means two main things; firstly you, the building owner, will receive the claim settlement and secondly, proof of legal liability is not required, nor is there a requirement to establish fault, this means insurers are able to offer a speedy reinstatement and you can avoid a lengthy legislative process. In addition to this, it means the potential risk of contractor insolvency can be mitigated. Lastly, the rights of the policy can be transferred following a sale. Ultimately, as the building owner, you do not want a contractor purchasing the inherent defect policy, you need the policy in your own name.

Tysers has been established for over 200 years and has been helping property developers with their latent defect insurance for decades. Due to this experience, we know exactly which providers to approach depending on your project type and size. In addition to this, unlike dealing directly with a building warranty provider, we can source the whole market, which means we are able to provide you with options to help achieve the best terms and cover.

You will benefit from our long-standing relationships and purchasing power and we can provide quotations from a variety of markets. We can compare policies on your behalf and identify best value in terms of both coverage and price. Our remuneration is usually included within the insurance premium.

Firstly, the NHBC will only deal with homeowners/homebuilders, so if a building is purely commercial, they will not insure it. Secondly, the NHBC costs more and has more restrictive policy terms. NHBC will always require a two-year builder liability period, which will mean that the developer is responsible for all remedial work for the first two years. Instead, Tysers can often provide day one risk transfer resulting in the insurer taking on the whole risk from practical completion and in turn provide peace of mind for the developer. Lastly, unlike the NHBC’s strict manual, our providers are far more lenient about how the property is built.

In order to sell your units, a mortgage provider will more than likely require a building warranty, however, in some cases, a professional consultant’s certificate (PCC) may suffice. That said, a PCC will only last six years, unlike our policies which last between 10-12 years as standard. Additionally, unlike with a building warranty where you do not have to prove fault, to have a successful claim with a PCC you would have to prove the architect’s negligence. Moreover, as you would be claiming against the architect, you would need to ensure their professional indemnity insurance is in place and has sufficient indemnity levels. If your development’s rebuild cost is eight figures or more, it is highly likely that your architect will not have adequate insurance to cover the entire development under a PCC.

Forms, forms and more forms. We know that you chose to be a property developer to build buildings and not spend time filling in complicated proposal forms. That’s why at Tysers we have tried to reduce the amount of data you need to supply. Sadly, however without all the required information we will be unable to help.

CLICK HERE TO DOWNLOAD OUR PROPOSAL FORM

If you need help and advice please contact:

Thomas Plumbly

Client Executive

T: +44 20 3037 8096

E: Thomas.Plumbly@tysers.com