What is Intellectual Property?

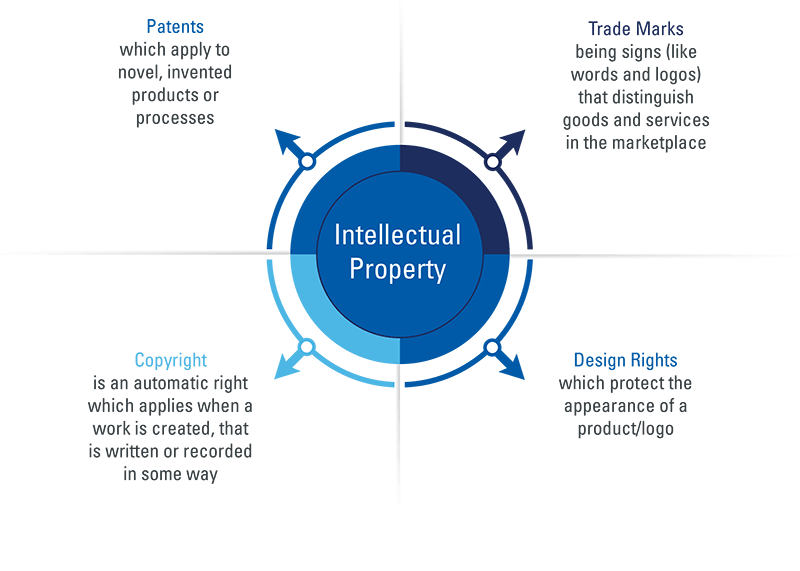

Intellectual property (IP) refers to creations of the mind, such as inventions; literary and artistic works; designs; and symbols, names and images used in commerce.

Source: World Intellectual Property Organisation (WIPO)

Intellectual Property includes:

Contributing factors and figures behind IP insurance

- Over the last three decades, intellectual capital has become the dominant asset class in terms of the value drivers for companies.

- Industry revenues increased by almost 700% between 2012 and 2018 with a prediction of continued increase in the future. It is forecast that revenues of IP and similar products in the UK will exceed $5bn by 2024.1

- IP litigation spend has increased to $3.3 billion from $1.7 billion in 2005. That uptick is due to several factors, including the larger damage awards that typically result from patent-infringement lawsuits asserting multiple claims.2

Why should I consider purchasing Intellectual Property (IP) insurance?

IP is increasingly the main asset of a company as opposed to the traditional, tangible ‘bricks & mortar, plant & machinery’ assets. The trend for businesses to therefore protect their intellectual know-how through patents and trade marks amongst other forms of IP is increasing.

This is a powerful first step towards protecting your balance sheet but IP is not policed and therefore third parties can copy your inventions, designs etc. with impunity; it is down to you, the IP owner, to enforce these rights and/or defend yourself against actual or alleged infringements of third party IP rights. Both of these procedures can be prohibitively expensive, irrespective of any additional damages awarded.

Other advantages to IP insurance protection

- An IP insurance policy can protect the company’s balance sheet from any unforeseen costs.

- It makes a company an attractive proposition for investors by adding a layer of financial protection to any invested capital.

- IP ownership and protection helps to convince investors that real market opportunities exist to commercialise a product and/or service.

- It enables a company, irrespective of size, to establish themselves in their respective marketplace through the financial protection the policy affords.

Industry sectors

- Oil & Gas

- Professional Services e.g. Architects

- Construction, including tool & machinery

- Renewable Energy

- Fashion

- Software development

- Financial Services

- R&D Entities

- University Spin-outs

- Manufacturing and Engineering

What does it cover?

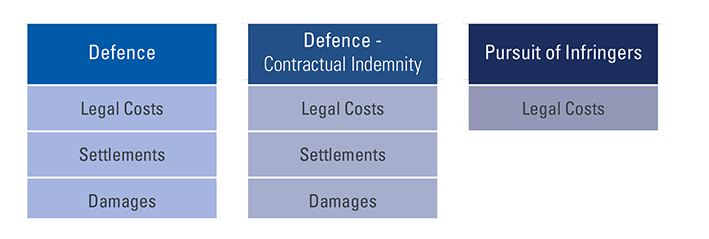

Defence, pays on your behalf the legal expenses and covered damages (which includes settlements) incurred in defending a third party claim against you alleging the infringement of their IP and for challenges to the validity of your IP.

Defence – Contractual Indemnity, pays on your behalf the legal expenses and covered damages (which includes settlements) arising out of an indemnity agreement or ‘hold-harmless’ commitment in a contract, arising out of IP infringement.

Pursuit of Infringers, pays on your behalf the legal expenses incurred, subject to you demonstrating reasonable prospects of success, as a result of any pursuit claim made by you against a third party arising out of the actual or alleged infringement of your IP.

Might I be too small or too large for this cover and how much does it cost?

We have arranged programmes for companies ranging from UK micro-entities with revenues and capitalisations of under £1m which attract premiums from circa £5,000, to FTSE100 companies attracting premiums in the hundreds of thousands of pounds.

No company is too small or too large as long as the product provides value in protecting your balance sheet.

1 Safeguarding intellectual property to enhance corporate value – KPMG & Lloyd’s of London September 2020

2 Morrison Foerster, Benchmarking IP litigation, 2019

Tysers Belgium

Tysers Belgium