Tysers announces senior roles for Tysers Singapore

Tysers is delighted to announce the appointment of Babita Rai as CEO, Tysers Singapore, and William Furness-Smith as Head of Marine, APAC. Babita Rai Babita…

Underinsurance is a concern for those working in the Entertainment Industry, as they require cover for many risks including cover for the specialist and often high-value equipment needed for live events and performances, broadcasting, production and editing. Policyholders should take particular care to ensure they are not underinsured and therefore liable to pay out-of-pocket for costs associated with the loss of crucial equipment.

This article covers the key areas where entertainment professionals and businesses are frequently underinsured and provides tips on how to avoid many of these common oversights.

Underinsurance occurs when the policyholder has insufficient cover for their needs.

Being underinsured is different to being uninsured, as an underinsured policyholder still has some level of cover, but when claims are settled the financial compensation received from insurers will be less than the amount needed to replace equipment or cover business interruption costs.

If equipment and assets are lost, stolen or damaged the policyholder may not be covered for all losses and, therefore, is responsible for a high proportion of the recovery costs.

In addition, the dangers of underinsurance reach beyond policyholders having to pay out-of-pocket to repair or replace equipment. If an insurer believes that the policyholder has intentionally or negligently underinsured equipment or assets, the insurer may refuse to pay a claim or void the insurance policy without returning the premium.

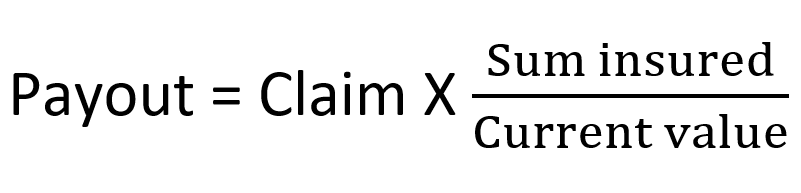

The Condition of Average is an insurance term used when calculating a claims payment where a policy is underinsured.

The average clause means the policyholder receives a proportional amount of the total loss suffered, rather than the full insured amount. The clause allows insurers to adjust the claim payment to reflect the actual level of insurance coverage.

If an insurer applies the condition of average, in the event of a loss, then the amount paid will be in the same proportion as the value of the underinsurance.

The formula used is;

For example, if a policyholder has insured their property for £100,000, but its actual value is £150,000, and they suffer a loss of £100,000, the condition of average would come into play. The insurer would apply the formula (insured amount/total value) to determine the percentage of the total loss that would be covered. In this case, the policyholder would receive 67% of the £100,000 loss, which would be £67,000.

It’s important to note that average clauses only apply if the policyholder is underinsured, and not if they are overinsured. If a policyholder has insured their property or assets for a value greater than its actual value, the average clause does not apply, and the policyholder would receive the full insured amount.

There are several key areas where those working in the Entertainment and events industry are frequently underinsured:

Equipment Insurance can cover a very broad range of items, defined by the insurer as ‘equipment used in connection with the business of the insured’ including both owned and hired in equipment. This definition essentially excludes personal items which are not used for business purposes, but can include a wide range of equipment including:

When taking out a policy, it is important to determine the costs of replacing all equipment on a ‘new-for-old’ basis, even if a complete loss seems unlikely to happen. The total figure is required by your insurer (even if you wish to select a lower amount of cover), as insurers use this to establish the total level of risk they are insuring.

There are several key areas where equipment is commonly underinsured. More detail is provided below:

Unless stated otherwise, most policies will stipulate new for old replacement for all equipment that is lost, stolen or damaged beyond reasonable repair. If a policyholder does not have a single item limit or overall cover that is sufficient to replace lost items on a new for old basis, they may have to pay out-of-pocket for the shortfall.

In recent years there has been a huge increase in the value of specialist audio visual, broadcast and computer equipment, therefore it is crucial that policyholders are aware that the price of replacement equipment may be considerably higher than when these items were originally purchased.

Tysers can arrange a single item limit of up to £250,000 for any item of equipment. Items with a higher value can also be insured following a valuation.

Equipment which has a higher market value than the cost of a new replacement item, such as musical instruments with a connection to an iconic band or musician, should be valued individually to ensure they are adequately covered. Policyholders with unique items of memorabilia should ensure these items have an up-to-date appraisal or valuation, particularly if there has been any change in the status of the musician or celebrity the item is connected with. For example, if a musician has recently passed away the value of any connected memorabilia may increase considerably.

Where equipment is required outside of a policyholder’s premises (for example equipment needed for live performances at various venues), they should ensure their policy provides sufficient cover for all locations.

If equipment is insured as ‘premises only’, but is taken off the premises and is lost or damaged, the policy will not cover replacement of these items. Similarly, if a policy cover is UK only and items are lost or damaged whilst overseas they will not be covered.

Tysers can provide equipment insurance through our Entertainment Elite scheme, with various territorial limits including:

Underinsurance of commercial properties of all kinds can have devastating consequences if fire, flooding, or other physical events cause major damage or destruction and there is a considerable shortfall in funds to rebuild the premises. In some cases, the high out-of-pocket rebuilding costs, in addition to long periods of business disruption, can lead to businesses having to scale back or even cease operations.

Many factors contribute to building underinsurance, some of the most common are:

Out-of-date valuations: Properties which have not been professionally valued recently for insurance purposes are at risk of being underinsured.

Changes of use: Policyholders should inform their broker as soon as possible about any changes of use, extensions or alternations to the property.

Market Value vs Rebuild Cost: Market value is often not an accurate reflection of the full cost to rebuild a premises when accounting for materials, labour, legal fees, architect and planning costs etc.

Listed Buildings: listed properties will typically take longer and cost more to rebuild, as these buildings must use specialist materials and traditional construction methods.

Find out more about Commercial Property Underinsurance here.

Any business that stores or handles sensitive data or personally identifiable information may be held liable in the event of a cyber attack or data breach. For businesses operating in the Entertainment sector, confidentiality is of utmost importance and a business may suffer considerable reputational damage, in addition to third party liabilities and legal costs, if client data is leaked.

A standalone Cyber Liability and Crime Insurance policy is highly advised to protect against all costs associated with a cyber attack or data breach, including recovery and business interruption costs. Some businesses may have limited cover provided through a commercial combined or business insurance policy, however this is often insufficient cover for a significant cyber event.

Many comprehensive Cyber & Crime policies also offer Cyber Breach Response Support, which is an invaluable resource when dealing with cyber-attacks. These services can include crisis containment, PR and reputation management and independent legal advice.

Find out more about cyber and crime insurance here.

If you are concerned that you might be underinsured, don’t wait until the next renewal date to act. If you are are a Tysers client, contact your usual Client Director or Account Executive for further guidance and advice. If you aren’t currently a Tysers client but want to find out more contact us here:

You can also read our Guide to Commercial Underinsurance, which covers many other key areas where commercial businesses of all kinds are at risk of underinsurance.