Do you understand all the risks in your business?

Many businesses face a complex catalogue of risks including health and safety, data protection, environmental management, and other industry-specific risks. Staying up-to-date on best…

The financial effects of a business being underinsured can be incredibly costly, and potentially devastating and yet according to the FCA, up to 40% of the UK’s SME’s could be underinsured [1]. When a major incident occurs destroying important assets or causing long periods of business disruption it can be difficult for a business to recover without adequate insurance in place.

Underinsurance occurs when the policyholder has insufficient cover for their needs.

Being underinsured is different to being uninsured, as an underinsured policyholder still has some level of cover, but when claims are settled the financial compensation received from insurers will be less than the amount needed to rebuild, replace stock or cover business interruption costs.

If an incident damages or destroys a business or its assets, the policyholder may not be covered for all losses and, therefore, is responsible for a high proportion of the recovery costs.

In addition, the dangers of underinsurance reach beyond business owners having to pay out-of-pocket for repairs or stock replacement. If an insurer believes that the policyholder has intentionally or negligently underinsured the business or its assets, the insurer may refuse to pay a claim or void the insurance policy without returning the premium.

This article covers the key areas where businesses are frequently underinsured, and provides tips on how to avoid many of these common oversights.

Underinsurance of commercial properties can have devastating consequences if fire, flooding, or other physical events cause major damage or destruction and there is a considerable shortfall in funds to rebuild the premises. In some cases, the high out-of-pocket rebuilding costs, in addition to long periods of business disruption, can lead to businesses having to scale back operations or even cease trading.

Despite this, research by the Royal Institute of Chartered Surveyors and the Building Cost Information Service suggests that around 80% of commercial properties have an element of underinsurance.

Many factors contribute to building underinsurance, some of the most common are:

Properties which have not been professionally valued recently for insurance purposes are at risk of being underinsured, therefore a commercial property valuation for insurance purposes should be a priority for business owners. In addition, any extensions, alterations or changes of use must be accounted for and property owners should inform their broker as soon as possible about any changes to ensure the property is covered appropriately.

Covid-19 resulted in many businesses changing layouts or altering their premises to comply with social distancing guidelines, including utilising areas or buildings not normally occupied by employees.

If a business has expanded recently into new areas of trading or business activities, this may involve new equipment and stock, increased building capacity or change of use for some building areas. Whatever the reasons for change of use, it is important that the business’s broker is aware of these changes to ensure that the business is not underinsured.

Business owners often make the mistake of insuring for the market value of the property, rather than the full cost of a rebuild. Market value is often not an accurate reflection of the cost to rebuild a premises, and other features such as car parks, driveways, lighting, fencing, and gates are often overlooked.

When calculating rebuild costs, estimates should include materials and labour, professional fees such as architect and planning costs, legal fees, demolition or make-safe costs, site clearance and access costs.

If the property is a listed building, it will typically take longer and cost more to rebuild, as these buildings must use specialist materials and traditional construction methods. Buildings that are furnished to an unusually high standard (including those with eco-friendly features) or that have been constructed using unconventional materials may also be more costly and time consuming to rebuild.

Underinsurance of contents and stock is another potentially costly oversight which could leave a business struggling with out-of-pocket stock and equipment replacement costs. Delays in replacing stock due to financial difficulties can also cause significant periods of business interruption, leading to more losses while the business is unable to resume normal trading.

When taking out a policy, it is important to determine the costs of replacing all stock and contents on a ‘new-for-old’ basis, even if a complete loss of stock or contents seems unlikely to happen. The total figure is required by your insurer (even if you wish to select a lower amount of cover), as insurers use this to establish the total level of risk they are insuring.

Covid-19 and Brexit have both caused significant supply chain disruptions over the past few years, and, as a result, some businesses have chosen to increase their stock levels. It is crucial that the broker is made aware of any changes, as the cover provided by the current policy may be less than the required replacement cost for the new stock levels. Additionally, the insurer may deem the insurance inadequate and apply the ‘Average Clause’, resulting in a lower settlement amount.

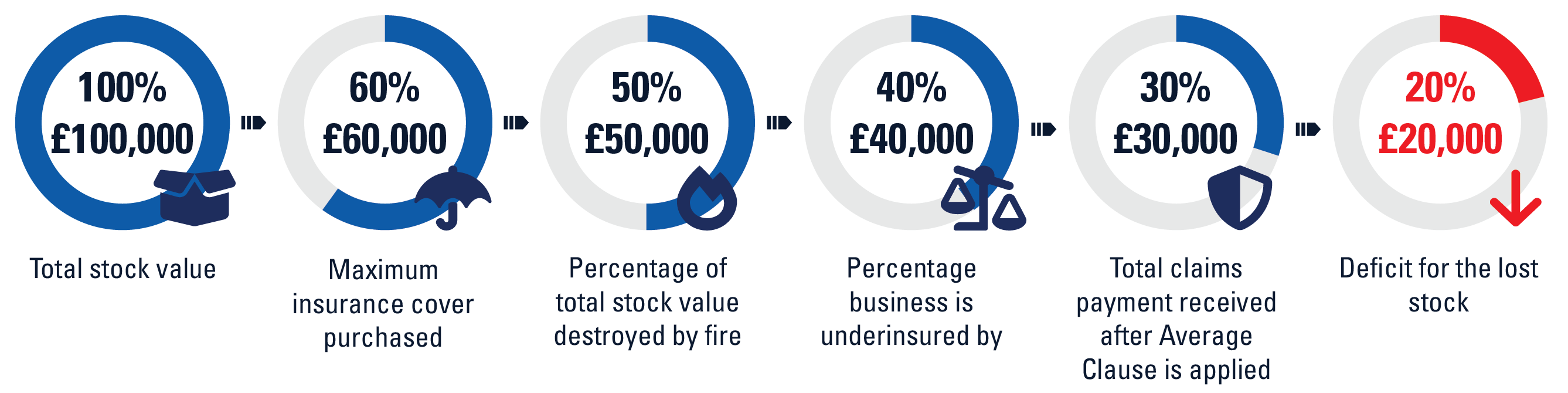

Insurers can apply the ‘Average Clause’ to claims made by underinsured businesses, which can result in a lower settlement amount than the policy limit. If an insurer discovers that a business has inadequate insurance, the settlement can be reduced by the same percentage as the asset is underinsured.

Unexpected problems with plant or machinery can be very costly, and it is important to consider not only the direct costs of replacing machinery or equipment, but all the costs associated with delays to production, fulfilment of orders and additional labour costs.

The British Insurance Brokers’ Association (BIBA) strongly advises that all machinery (both hired and owned) is insured for the full value of replacing ‘new-for-old’. In addition, delays caused by any specialist machinery that would take a significant amount of time to replace must be accounted for.

Supply chain delays have been significantly exacerbated in recent months by a combination of factors including the Covid-19 pandemic, Brexit and the Ukrainian conflict.

There are many scenarios that should be considered to fully understand how a business’s trading could be interrupted. From physical events such as a fire or flood, to supply chain disruptions and cyber-attacks, multiple factors will inevitably influence how long a business would need before it resumes normal trading following a major incident.

Selecting a much shorter period of cover for business interruption than the likely period of actual disruption is a common oversight, leaving businesses with ongoing additional costs after insurance pay-outs have ceased.

When selecting cover, it is also important to note that the definition of profit used for business interruption insurance is different to the definition of profit for accounting purposes. Gross profit for business insurance is defined as turnover less the cost of raw materials and other expenses directly variable with turnover.

A business continuity plan can help a business owner consider all worst-case scenarios and present a true picture of the time frame and resources needed for the business to return to pre-loss turnover levels. Advice and assistance on business continuity is available to all Tysers’ clients through Tysers Risk Services online portal.

You can learn more about Tysers Risk Services & how to register here.

Despite almost 40% of businesses reporting a cyber security attack or breach in the past 12 months [2], many businesses still do not have a standalone cyber liability policy which would provide adequate cover in case of a cyber-attack or data breach.

Often there may be limited levels of cover provided through a commercial combined or other business insurance policies. However, as this cover is usually limited it may be insufficient for businesses that store or handle sensitive data or personally identifiable information.

A comprehensive cyber insurance policy will provide financial compensation for the direct costs incurred by the business, and any liabilities payable to third parties following a cyber-attack, data breach or loss of data.

Many policies also offer Cyber Breach Response Support, which is an invaluable resource when dealing with cyber-attacks. These services can include crisis containment, PR and reputation management and independent legal advice.

Find out more about cyber insurance here.

If you are concerned that your business might be underinsured, don’t wait until the next renewal date to act. Contact your usual Client Director or Account Executive for further guidance and advice.

[2] Cyber Security Breaches Survey 2021 – GOV.UK (www.gov.uk)