Do you understand all the risks in your business?

Many businesses face a complex catalogue of risks including health and safety, data protection, environmental management, and other industry-specific risks. Staying up-to-date on best…

Cyber attacks are on the rise, and businesses of all sizes are being targeted more frequently. Cyber criminals are also employing increasingly sophisticated tactics to bypass cybersecurity measures, therefore it is more important than ever for businesses to protect against cyber attacks.

(Source: IBM Cyber Security Intelligence Index Report)

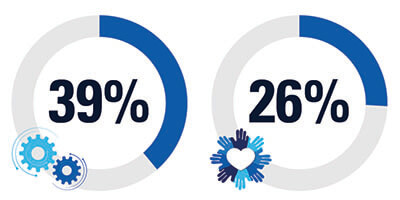

This could be the unintentional action, or lack of action taken by employees and users that cause, spread or allow a security breach to take place. Data breaches can also be caused by more sinister forces such as malicious employees or sophisticated cybercriminals.

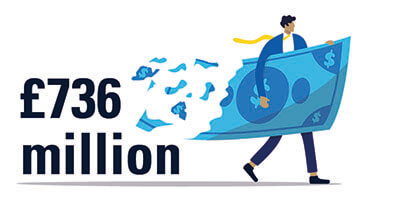

(Source: NFIB Fraud and Cyber Crime Dashboard)

Cyber crime shows no indication of slowing down, with reports of incidents increasing year on year. This figure does not account for all cyber breaches (for example, those caused by human error without malicious intent) so the total number for all cyber attacks and breaches will be much higher.

(Source: Cyber Crime Cost UK £2.5bn in 2021 (holistic.it))

The average cost of a cyber breach can range from thousands up to millions. It is important to understand your business’ risks and the potential losses that could occur from a cyber attack or breach, and invest in adequate cyber insurance to protect your business.

(Source: Cyber Security Breaches Survey 2021 – GOV.UK (www.gov.uk))

Sectors that are at increased risk of cyber crime include banking and financial companies, healthcare and hospitality providers, legal firms and small businesses.

(Source: State of Cybersecurity Report 2021 | 4th Annual Report | Accenture)

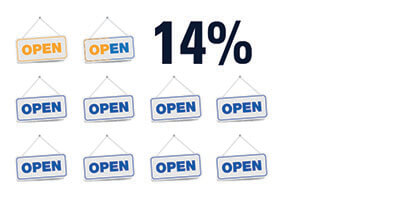

Cyber criminals are becoming increasingly persistent, and often a business will be subject to a range of different cyber attacks from phishing schemes to password attacks and ransomware.

Small businesses are particularly vulnerable to attack as many do not have the same cybersecurity budgets as larger companies. Although sophisticated cybersecurity measures are often costly, there are other measures small businesses can take to protect against cyber attacks including; keeping antivirus software and firewalls up to date, using VPNs for encrypted data transfer and remote file access, enforcing secure password policies and multifactor authentication.

The financial impact of a cyber attack can be devastating and leave businesses liable for third party costs and reputational damage, in addition to the direct costs incurred by the business following a cyber attack or breach. Small businesses can protect themselves by putting in place a comprehensive cyber and crime insurance policy that will provide financial compensation for both direct costs and any liabilities payable to third parties.

(Source: 2022 Data Breach Investigations Report | Verizon)

(Source: Cyber Security Breaches Survey 2022 – GOV.UK (www.gov.uk))

Ransomware is a type of malware (malicious software) which is used to lock systems and devices, making them unusable until a ransom has been paid. Malware attacks may also encrypt or delete important data, resulting in financial losses and long periods of business interruption.

(Source: Cyber Security Breaches Survey 2022 – GOV.UK (www.gov.uk))

Phishing is a type of social engineering, where criminals impersonate organisations via email, text message, or other means, in order to steal sensitive information or obtain money. Some phishing emails appear very convincing, so training is key to ensure employees know what to look for and where to report any suspected phishing attempts.

Robust cybersecurity is essential to protect your business, and it’s important to invest in some cybersecurity measures regardless of business size or industry. It is also a requirement of cyber insurance cover that the policyholder ensures there is adequate cybersecurity measures in place, otherwise if an incident occurs claims may be voided.

It is also equally as important for your employees to have up to date training to stay ahead of the increasingly sophisticated methods used by cyber criminals. Some cyber insurance policies even offer cybersecurity training, to help reduce the risk of claims caused by human error.

Cyber insurance cover helps your business offset the costs of recovery after a cyber-related security breach, loss of data, a ransomware attack or a similar event.

A comprehensive cyber insurance policy will provide financial compensation for the direct costs incurred to the business and any liabilities payable to third parties following a cyberattack, a data breach or loss of data.

Many policies also offer Cyber Breach Response Support, which is an invaluable resource when dealing with cyber-attacks. These services can include crisis containment, PR and reputation management and independent legal advice.

Some businesses may have cyber cover within a commercial combined policy, but this cover is often less comprehensive than a standalone Cybersecurity policy and may not provide sufficient cover for all the costs associated with a largescale cyber attack or data breach.

Find out more about cyber insurance here

To get started with a new cybersecurity policy, or make an enquiry about your existing cover: