Do you understand all the risks in your business?

Many businesses face a complex catalogue of risks including health and safety, data protection, environmental management, and other industry-specific risks. Staying up-to-date on best…

You are using an outdated, unsupported browser that may not display this website properly.

Please upgrade to a modern browser for a better browsing experience. We suggest:

…but many businesses find it hard to access comprehensive flood insurance without prohibitively high premiums or large excesses.

Businesses in higher risk areas may be unable to access any cover through traditional insurance policies, leaving them even more vulnerable to serious financial losses in the event of flooding and the subsequent damage caused.

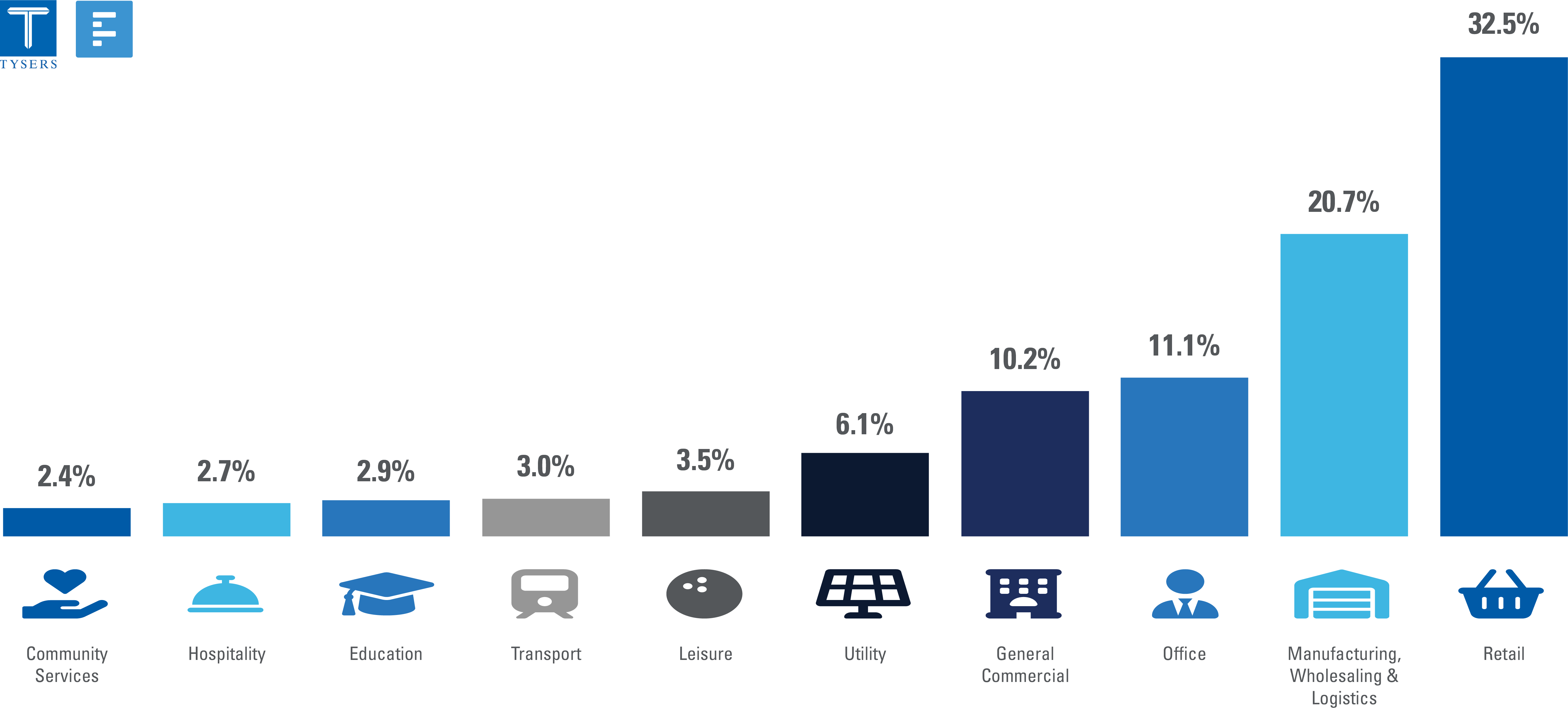

*Manufacturing, retail and commercial office buildings are among the most at risk from flood damage.

[*Flood Flash Commercial Risk Report 2022 – you can read the full report here]

Many businesses will face upfront costs in the wake of flood damages and may have to pay out-of-pocket to avoid long periods of business interruption.

Many properties at significant risk of flooding may also struggle to get adequate flood insurance and even those with insurance often struggle to recover from flood damage. Traditional flood insurance can take many months to settle claims, as damages must be assessed and calculated before claims can be paid, and there are often restrictions and limitations placed on the use of pay-outs.

FloodFlash is an innovative flood solution that offers immediate pay-out in the event of a flood. Many business owners have been heavily financially impacted following a flood, due to long periods of business interruption and the requirement to cover large excess payments on their insurance policies. These business owners have now chosen to protect their flood risk with FloodFlash.

The FloodFlash solution can be purchased as a standalone protection or to complement your existing insurance, giving you the benefit of a quick cash pay-out to cover immediate costs while flood damages are assessed, and claims settled.

If your business is at higher risk, combining traditional flood insurance with FloodFlash could provide a comprehensive solution to protect against flood risk.

FloodFlash simply uses an automated depth monitoring sensor, which is installed by a FloodFlash technician at your property. The sensor will automatically alert FloodFlash when flood waters reach the agreed trigger level, and the agreed settlement figure will be transferred, in full, within two days.

Unlike traditional flood insurance, there are no restrictions on what the pay-out can be used for, which allows you to cover immediate costs such as stock replacement, property damage and other business interruption costs.

The cost will be based on a number of factors, the main being trigger depth and settlement amount. You can select the depth at which a pay-out is triggered and the settlement amount to suit the needs of your business, and the cost will be calculated based on these factors. You will also have the option to select multiple trigger depths and settlements, to cover more severe damages caused by higher flood waters.

Businesses at risk of flooding can also benefit from investing in Property Flood Resilience (PFR) measures. These measures can reduce the risk of flooding and associated financial losses (which can reduce the cost of FloodFlash) and also limit damages to property, equipment and stock.

Flood resistance measures may include:

Recoverability measures you may be able to incorporate:

To find out if FloodFlash could help protect your business, contact your Tysers broker who can provide more information.

You can also read more about FloodFlash below:

Many businesses face a complex catalogue of risks including health and safety, data protection, environmental management, and other industry-specific risks. Staying up-to-date on best…

Do you know your Cybersecurity risk? 10 important statistics all business owners should know Cyber attacks are on the rise, and businesses of all sizes…